Updates to New York’s Paid Family Leave Law: Effective January 1, 2019

Updates to New York’s Paid Family Leave Law: Effective January 1, 2019

December 19, 2018

On January 1, 2018, New York State introduced its Paid Family Leave (“PFL”) Law. PFL is a law that requires job-protected, paid time off from work for private employees:

- to care for a seriously ill family member;

- to bond with a newborn, adopted, or foster child; or

- for military exigency (as defined by the Federal Family Medical Leave Act).

In our Early Season 2018 “Benefits Toolbox” newsletter and on the Benefit Funds’ website (www.nyccbf.org), we notified you of this law by way of a Summary of Material Modifications (“SMM”). As part of this SMM, we reported that the NYCDCC Welfare Fund would be providing this benefit to active and eligible participants on behalf of their employers. For 2019, changes to PFL are scheduled, which, as the provider of the benefit, we have detailed for you below.

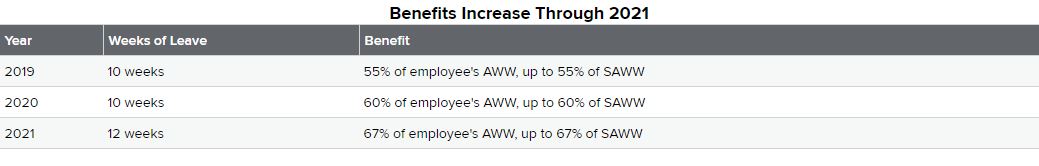

During 2018, active and eligible participants were allowed to take eight weeks job-protected, paid time off via PFL and receive 50% of their average weekly wage, capped at 50% of the New York State average weekly wage. (The average weekly wage is the average of your last eight weeks of pay prior to starting PFL). Effective January 1, 2019, these limits will increase. Active and eligible participants will now be afforded up to ten weeks job-protected, paid time off via PFL and an ability to receive 55% of their average weekly salary (The average weekly salary is capped at $746.41). Incremental increases in these limits will also continue through January of 2021. You can read more about this by visiting New York State’s official website at https://paidfamilyleave.ny.gov/2019.

Despite these changes, the process for applying for PFL will remain the same. You may obtain a claim form the Funds’ website at www.nyccbf.org or by contacting the Fund Office at (212) 366-7300 or (800) 529-FUND (3863). You will need to complete Part A of the claim form and submit that, along with twenty-six weeks (26) of pay stubs for the period immediately preceding your effective leave date, in order to determine eligibility and benefit payment. Payment will be issued by Wesco Insurance Company, the insurer for this benefit. Failure to provide the appropriate documentation will result in a delay and/or possible denial of the claim. The claim form and all necessary documentation should be sent to the following:

VIA EMAIL

VIA MAIL

NYCDCC Welfare Fund

395 Hudson Street, 9th Floor

New York, NY 10014

VIA FAX

(212) 366-3301