Important Information for Your 2016 Taxes Regarding Health Coverage and Form 1095-B (or C)

Important Information for Your 2016 Taxes Regarding Health Coverage and Form 1095-B (or C)

February 28, 2017

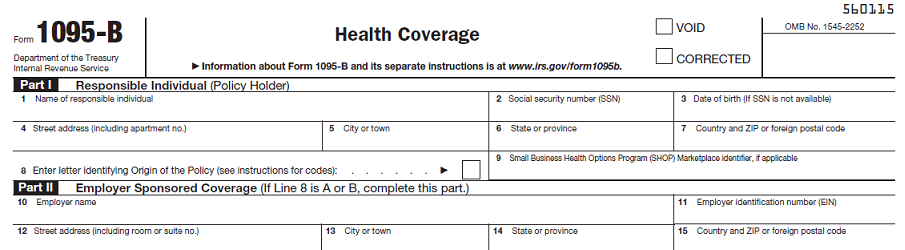

The Internal Revenue Service (the “IRS”) now requires that you report whether or not you had health coverage when you file your taxes. If you had health coverage during 2016 from the New York City District Council of Carpenters Welfare Fund (the “Welfare Fund”), the Welfare Fund will be mailing you a Form 1095-B or Form 1095-C by Thursday, March 2nd. Form 1095-B (or C) will show whether or not you and your eligible dependents had health coverage, and the months in 2016 that you had coverage. If you receive Form 1095-B (or C) after you file your taxes, you will not be required to amend your tax return. Keep Form 1095-B (or C) with your tax records.

If you would like more information about Form 1095-B (or C), the IRS’s website has a Question and Answer page dedicated to this subject. To visit this section of the IRS’s website, please click the following link: https://www.irs.gov/Affordable-Care-Act/Questions-and-Answers-about-Health-Care-Information-Forms-for-Individuals.