Important Information for Your 2015 Taxes Regarding Health Coverage and Form 1095-B

Important Information for Your 2015 Taxes Regarding Health Coverage and Form 1095-B

February 16, 2016

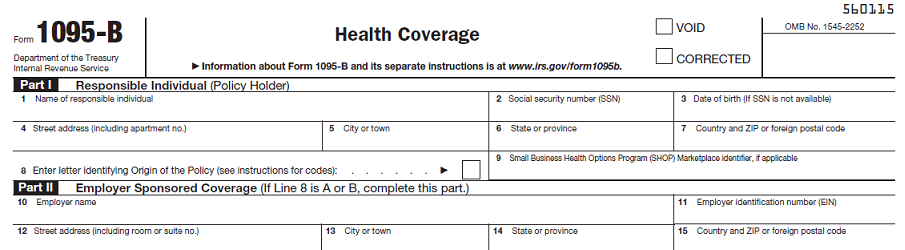

The Internal Revenue Service (the “IRS”) now requires that you report whether you had health coverage when you file your taxes. If you had health coverage during 2015 from the New York City District Council of Carpenters Welfare Fund (the “Welfare Fund”), the Welfare Fund will send you a Form 1095-B. Form 1095-B will show whether you and your eligible dependents had health coverage and the months in 2015 that you had coverage. The Welfare Fund is required to send you Form 1095-B by no later March 31, 2016. If you receive Form 1095-B after you file your taxes, you will not be required to amend your tax return. Keep Form 1095-B with your tax records.

If you would like more information about Form 1095-B, the IRS’s website has a Question and Answer page dedicated to this subject. To visit this section of the IRS’s website, please click the following link: https://www.irs.gov/Affordable-Care-Act/Questions-and-Answers-about-Health-Care-Information-Forms-for-Individuals.